I do not take a single newspaper, nor read one a month, and I feel myself infinitely the happier for it.

— Thomas Jefferson (1743-1826)

Weekly Bulletin

Hello folks,

Unfortunately, as soon as I mentioned Game of Thrones, it started getting wayy less excellent.

sigh*

Anyways, few bit of news to cover then we’ll jump into the markets.

Let’s go.

Binance hack & talk of re-org

Binance was hacked and hackers were able to withdraw 7,000 BTC.

Exchanges are bound to get hacked and Binance is well enough off that it will use its SAFU fund to cover this incident in full so user funds will be affected.

No big deal.

The more interesting thing is some of the conversation in the aftermath.

Specifically, this.

What CZ is referring too is a forced bitcoin chain rollback, a 51% attack (where a party acquires a majority of the network hash rate) .

This is how it would work in theory:

The problem with this is that while it sounds good on paper, it’s largely unfeasible.

Even if CZ was to offer miners all 7,000 BTC that were compromised, it would probably not be a financially interesting roll back for the miners.

Here are some relevant excepts from a stack exchange discussion.

The attack may take a long time if it uses existing mining capacity. The fraction of miners participating (via direct control or bribes) and the amount of blocks to revert will determine how long.

For example, to revert just 6 blocks (1 hour worth of confirmations) before coinbases start maturing, the attacker will need to get immediate control over 51.5% of the hashing power. If he falls short of that percentage or requires more time to convince some of the miners, it will take him over 33 hours and reverting more than 100 blocks in total, so rewards from the first blocks may have been spent already.

During the time it takes to reorg the chain, the capacity on the longest chain would be reduced to less than half of the usual capacity. You can expect this to have an impact on fees and miner rewards, as the offer for transaction confirmations is not able to satisfy demand. Higher fees on the honest chain will put additional pressure on miners carrying the attack. It's difficult to predict how high they can go in the middle of all that FUD, with many people rushing to move coins to trade.

A significant reorg doesn't affect just direct victims, every bitcoin holder would be affected due to a diminished confidence in the system, a reduction in Bitcoin utility and a drop in the price of the coins as a consequence. PoW is a trust-minimized market signal enabling us to scale social consensus. But, if somebody builds heavier chain with a lower value, breaking PoW trust-minimization, users can choose not to follow it and make a UASF, invalidating the reorg:

Also consider this: If I had a significant portion of the hashpower, and I wanted my competitors to waste their resources mining a chain that will not end up being accepted, then why wouldn’t I just pretend that I was going to mine a rollback chain, but then actually keep working on the already-established chain?

If the parties invested in a rollback were counting on my hashpower to succeed in their plan, then by not participating in the rollback I would guarantee its failure, and increase my profits at the same time (since less hashpower would be working on the already-accepted chain).

Besides folks, it would damage the whole bitcoin immutability meme and we can’t have that can we?

Good thing CZ actually came to the same conclusion, good lol from him actually being called out below.

Recommended Reading

Bitcoin is a Demographic Mega-Trend

Blockchain Capital published a report which highlights that younger demographics are leading in terms of Bitcoin awareness, familiarity, perception, conviction, propensity to purchase, and ownership rates.

You can read the report here.

Nearly half (48%) of those aged 18–34 ‘strongly’ or ‘somewhat’ agree that ‘it’s likely most people will be using Bitcoin in the next 10 years’

Market Sentiment

The short squeeze

Last letter I wrote that there were lots of shorts are pilling up, and a that a short squeeze looked unlikely.

I said it looked unlikely because I thought there would be more then enough sellers and ample bitcoin supply, but I was wrong.

Here’s an explanation.

In a short squeeze, people borrow shares to bet against a company.

They eventually need to buy those shares back to cover their negative position.

If the folks that actually hold the shares, or in this case bitcoin, decide that they don’t actually want to sell their bitcoin back to the short sellers, the price can run upwards out of control.

When you buy, the price rises = added demand.

When you sell, the price falls = added supply.

When there are too many shorts, the price can rise rapidly because everyone is buying back at market price (closing their position) to avoid their shorts going underwater.

This is called a "short squeeze."

And boiii did it squeeze.

(Visual representation of the shorts going down and longs going up)

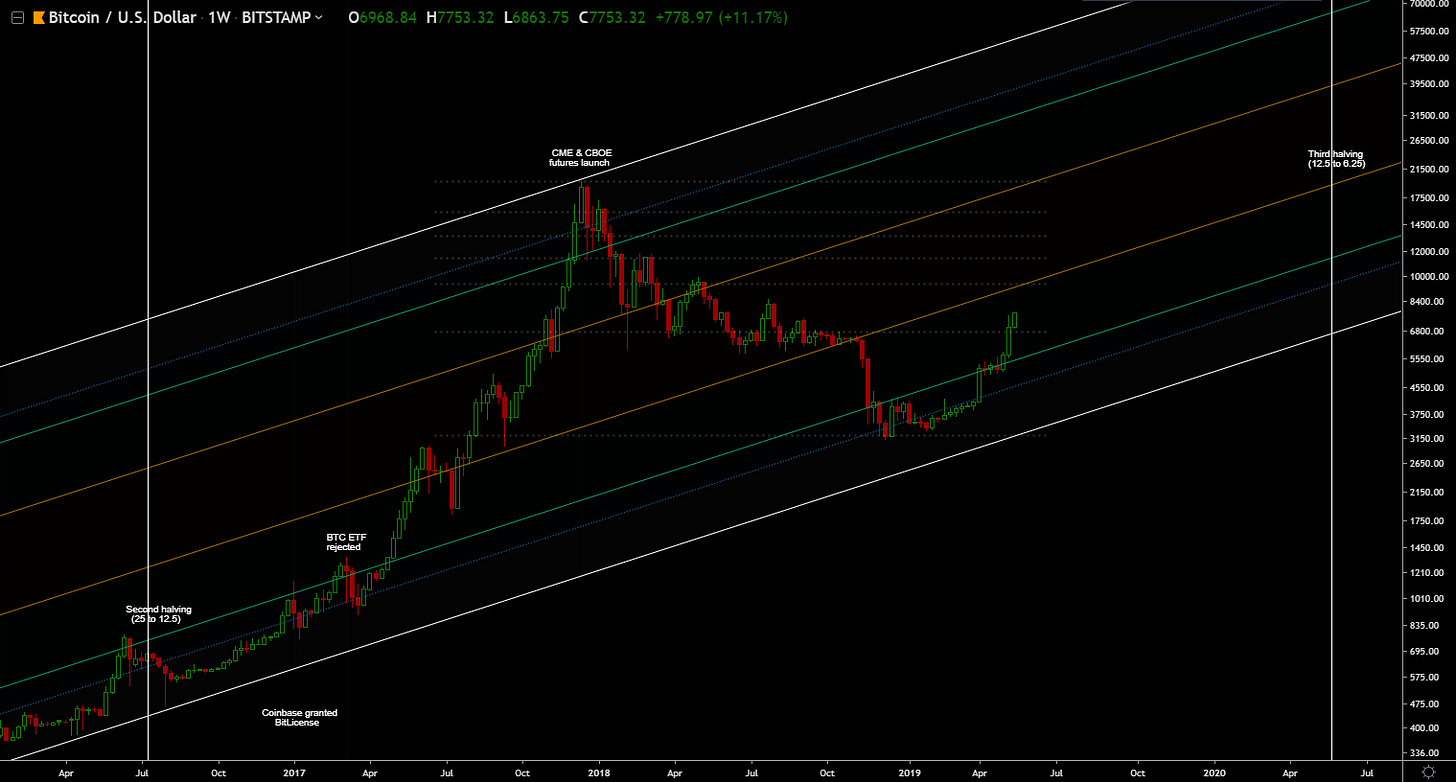

Bitcoin (Macro Trend Lines)

What a blast.

Bitcoin (Moving Averages)

The TD

Daily TD

3 Day TD

Weekly TD

Monthly TD

Bitcoin (Support/Resistance Levels)

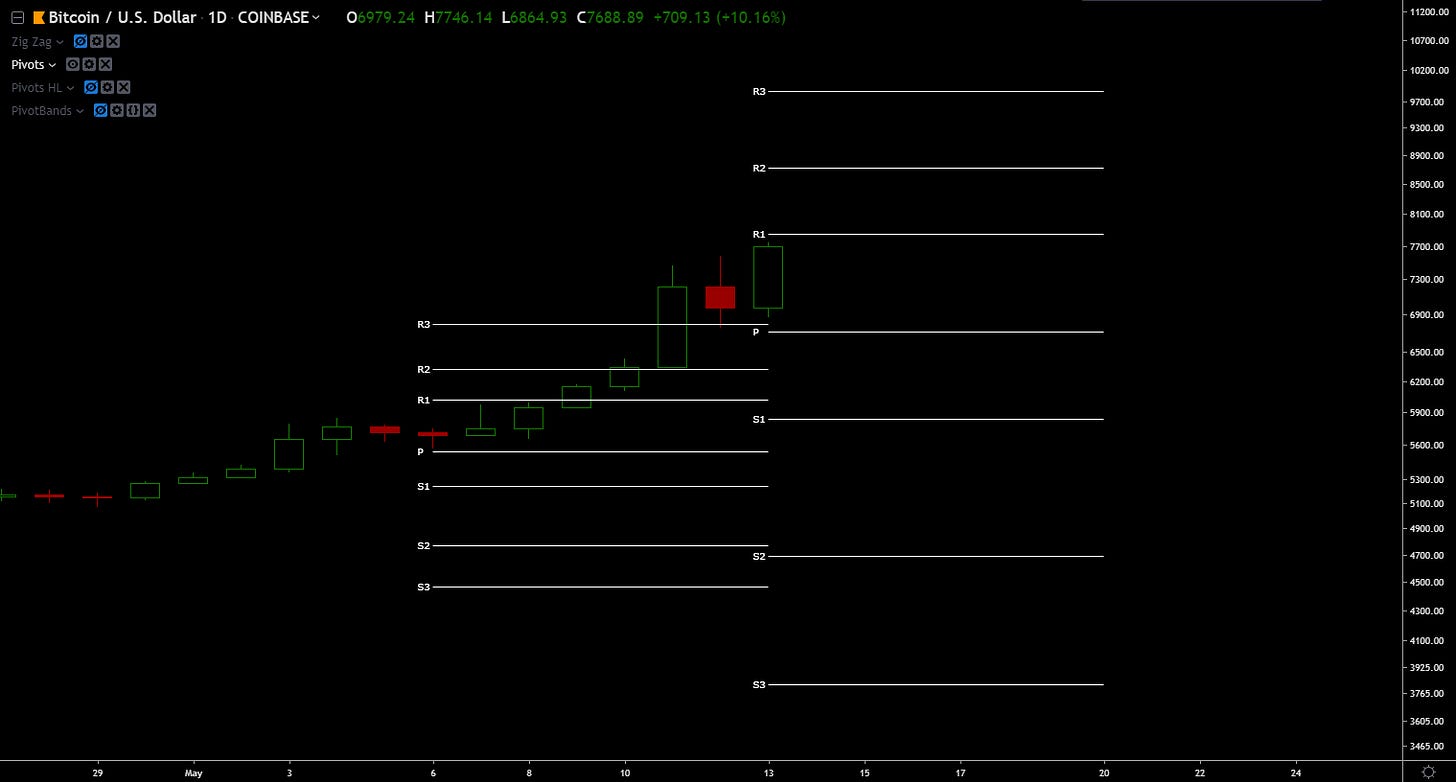

Weekly Pivot Points

Monthly Pivot Points

Volume

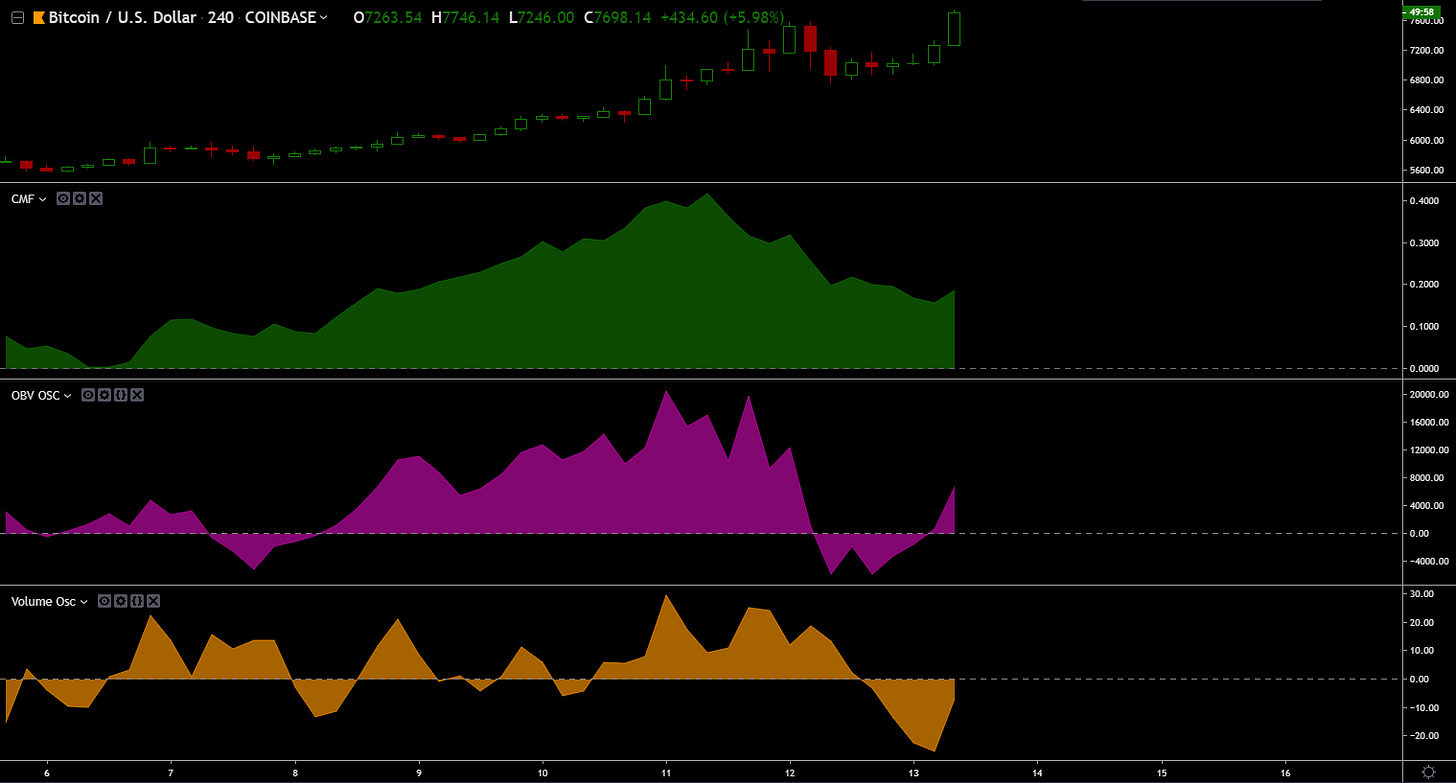

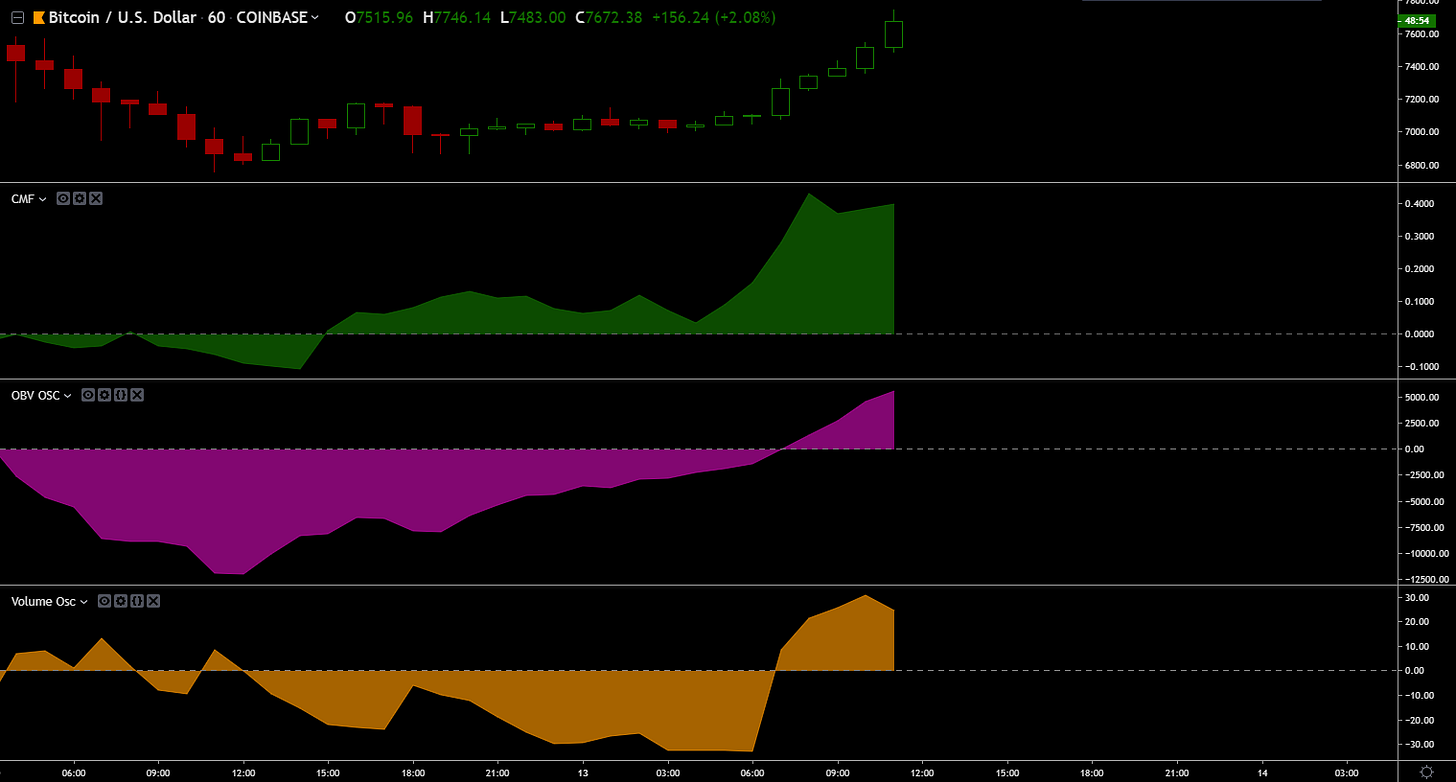

Daily Volume

4h Volume

2h Volume

1h Volume

Bitcoin (Macro Overview)

We’re about ~375 days away from the next halving event.

As of May 13, 2019 my confidence level are:

We've already bottomed = about 90%.

The end

What do you folks think?

Continue the discussion in our Telegram group.

That’s all for now.

See you later space Cowboy

-Dmitriy